Karane Enterprises A Calendar-Year Manufacturer 2026 Calendar Assessment Overview. In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business,.

Karane enterprises, a calendar year manufacturer based in college station, texas, began business in 2017. In the process of setting up the business,. In the process of setting up the business, karane has acquired various types of assets.

Source: www.chegg.com

Source: www.chegg.com

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business,. In the process of setting up the business, karane has acquired various types of assets.

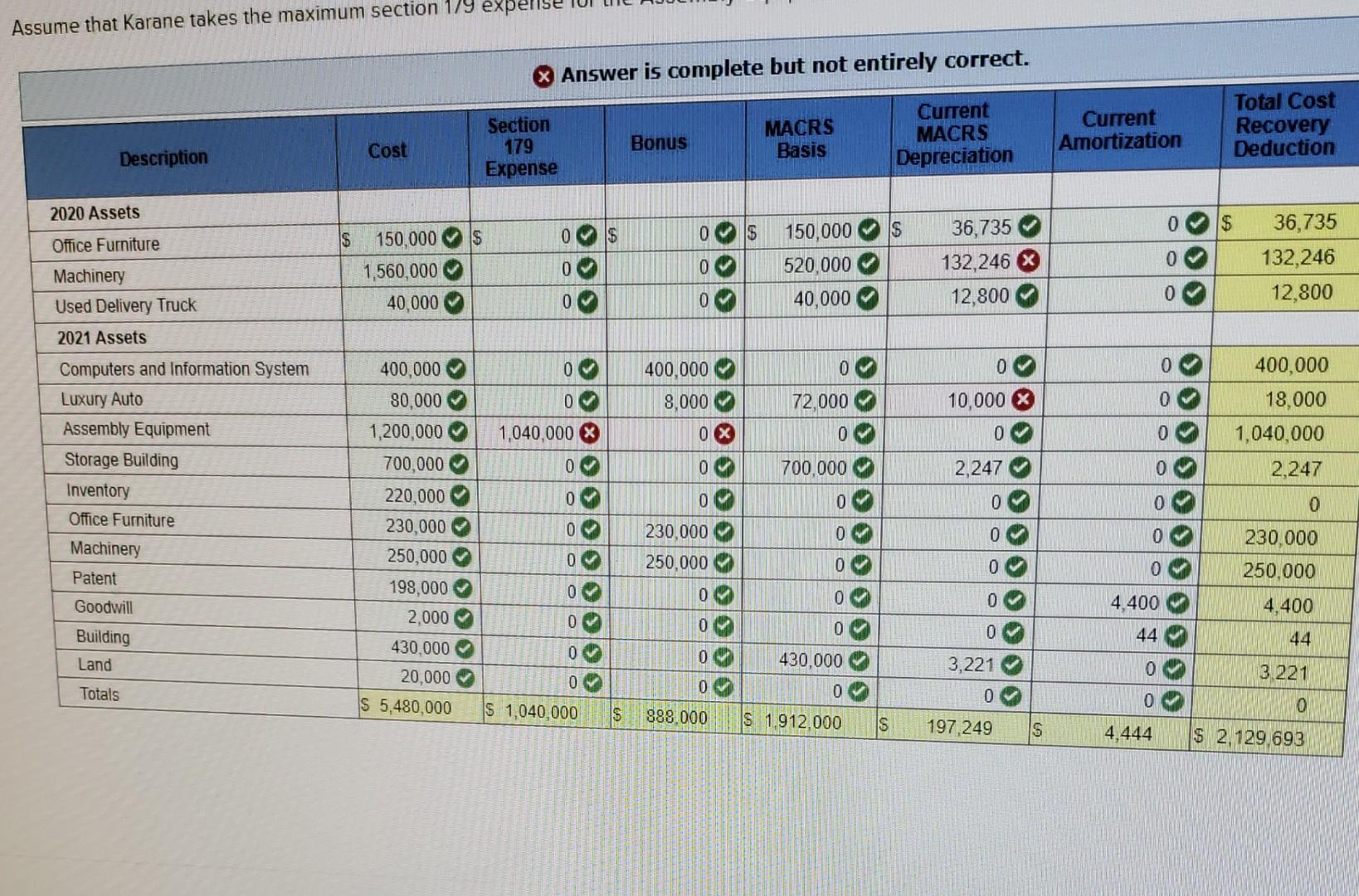

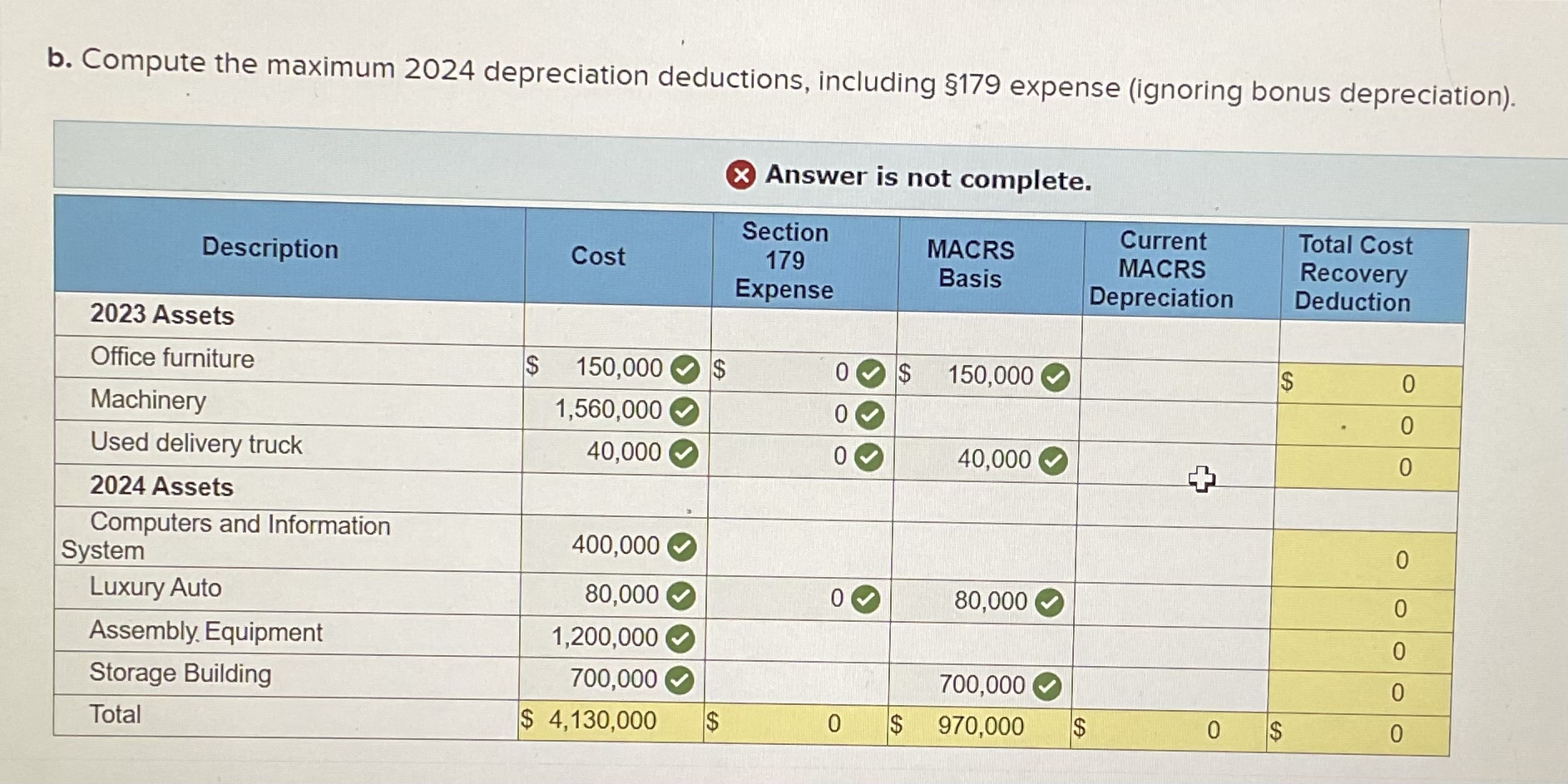

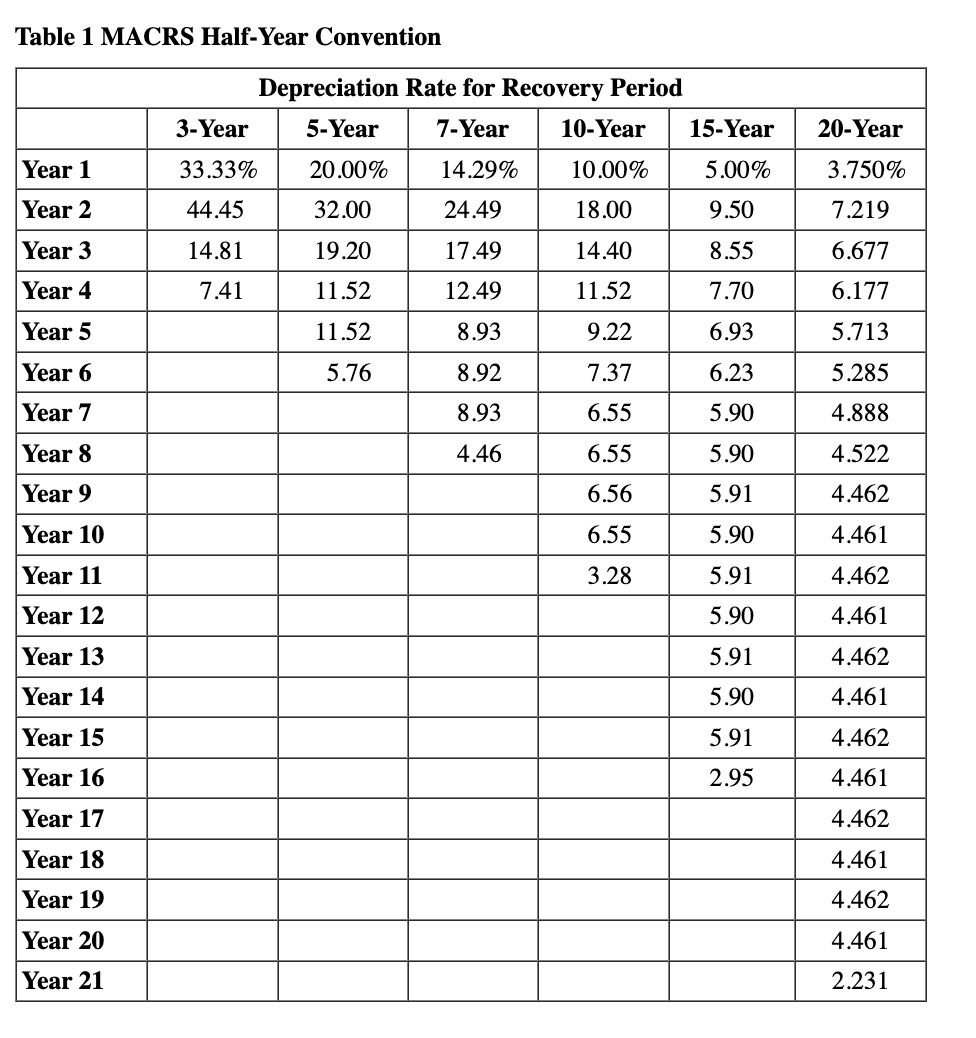

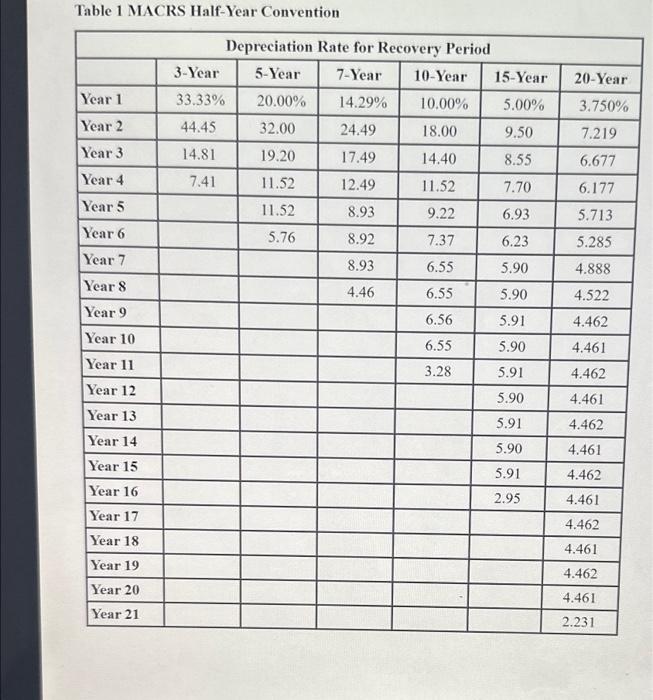

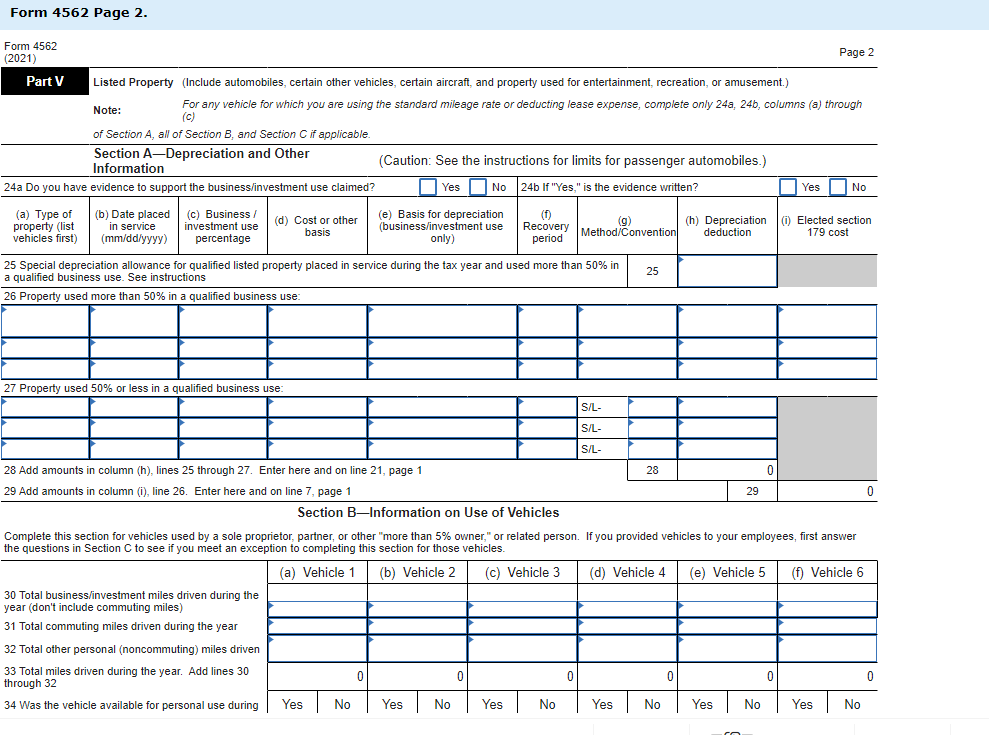

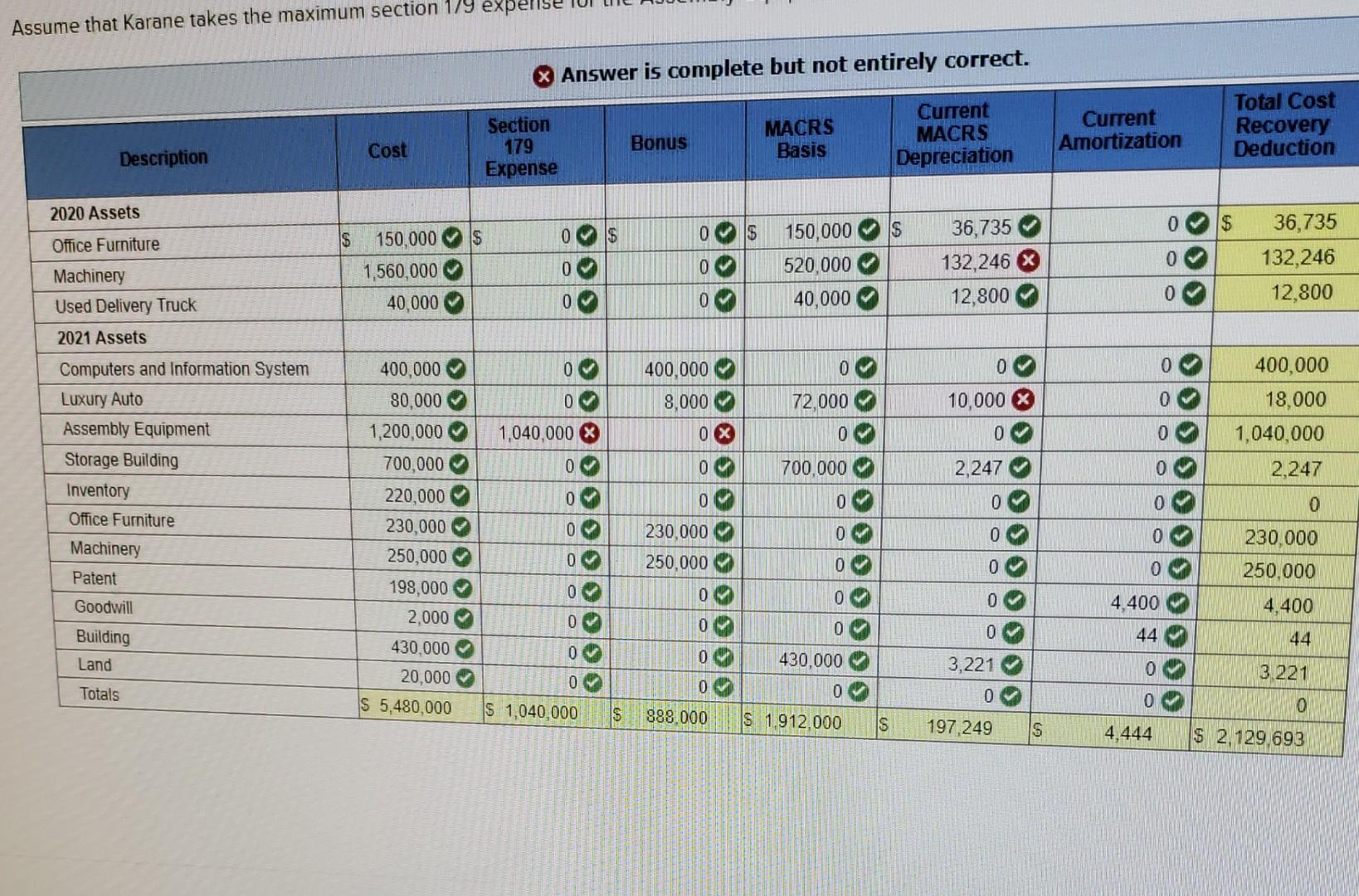

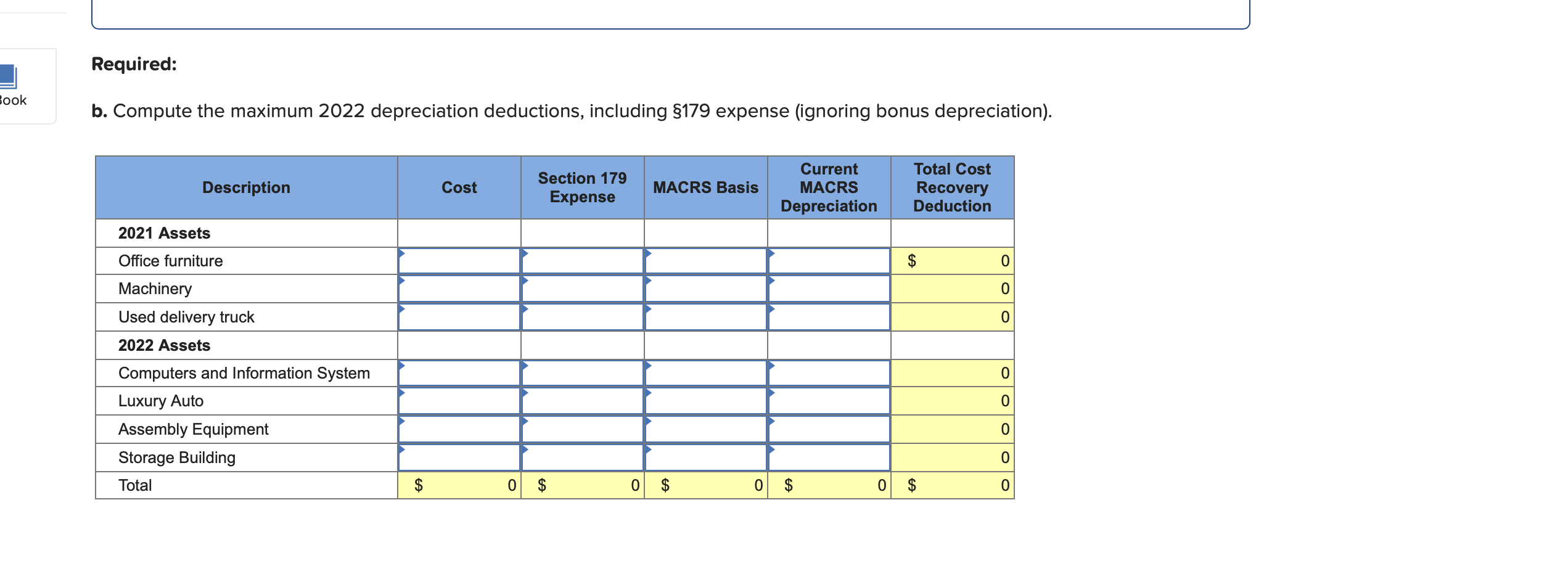

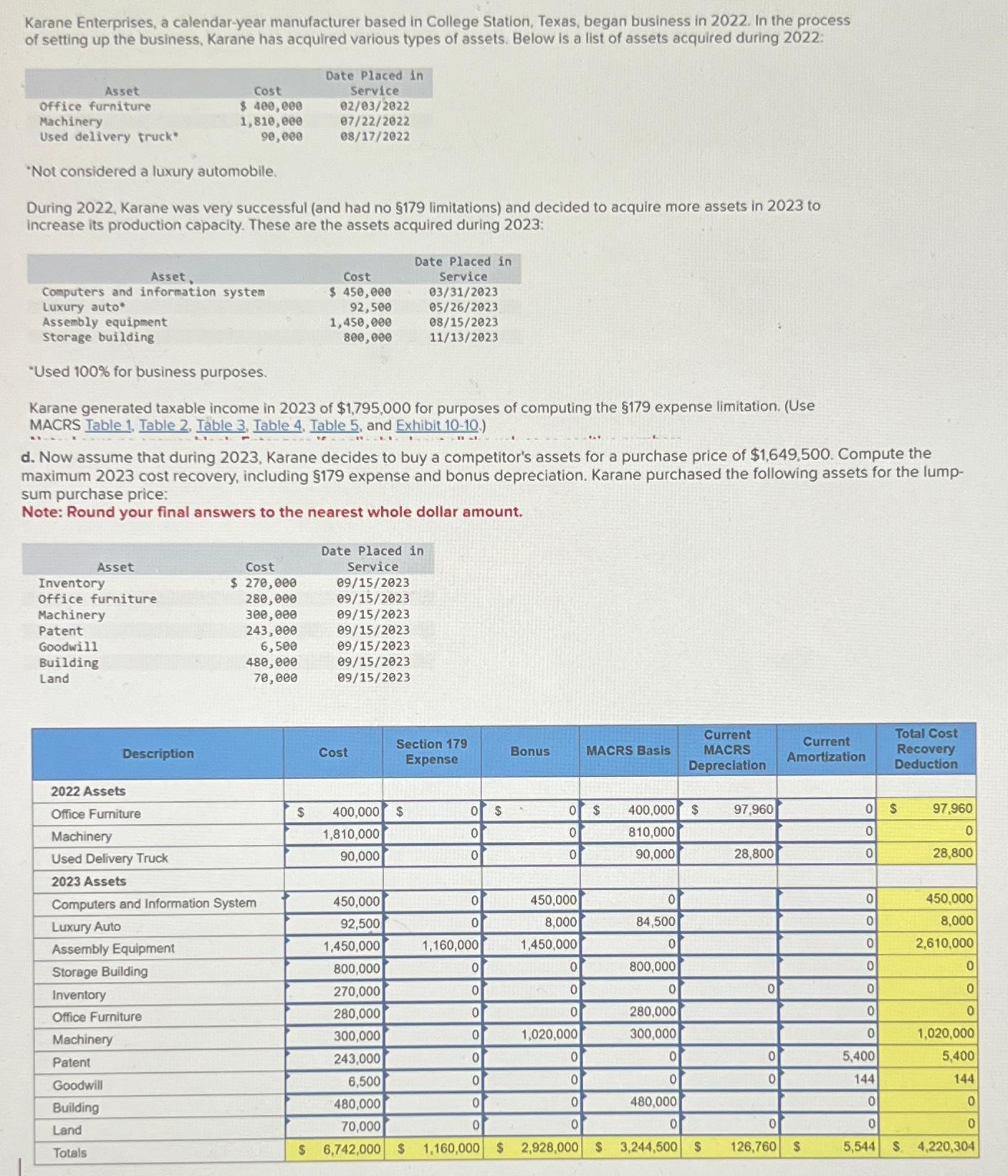

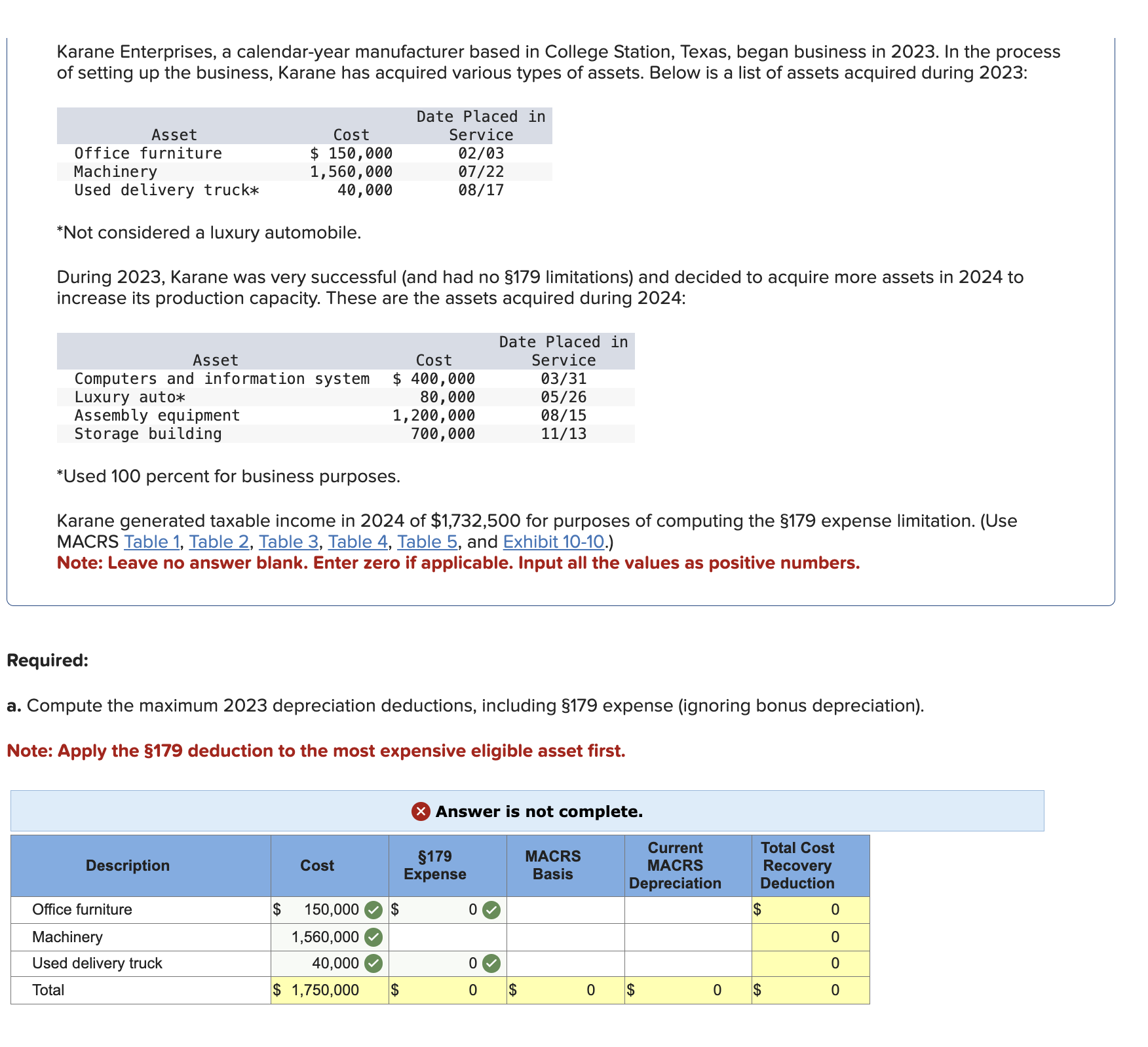

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these.

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business,.

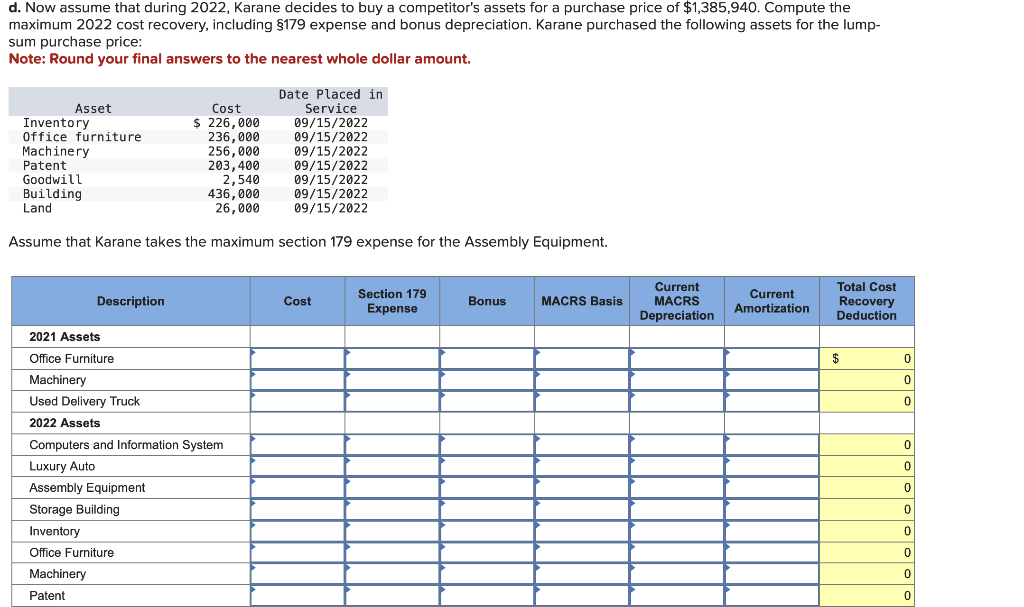

Karane Enterprises, a calendaryear manufacturer To calculate the depreciation expense for karane enterprises' assets acquired in 2022 and 2023, we need to use the modified accelerated cost. In the process of setting up the business, karane has acquired various types of assets.

Karane Enterprises A CalendarYear Manufacturer 2025 Bridgette B. Jelks Karane enterprises, a calendar year manufacturer based in college station, texas, began business in 2017. To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these.

Source: www.bartleby.com

Source: www.bartleby.com

Answered Karane Enterprises, a calendaryear… bartleby In the process of setting up the business, karane has acquired various types of assets. To calculate the depreciation expense for karane enterprises' assets acquired in 2022 and 2023, we need to use the modified accelerated cost.

Source: www.chegg.com

Source: www.chegg.com

Karane Enterprises, a calendaryear manufacturer To calculate the depreciation expense for karane enterprises' assets acquired in 2022 and 2023, we need to use the modified accelerated cost. In the process of setting up the business, karane has acquired various types of assets.

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business,.

Source: www.bartleby.com

Source: www.bartleby.com

Answered Karane Enterprises, a calendaryear… bartleby To calculate the depreciation expense for karane enterprises' assets acquired in 2022 and 2023, we need to use the modified accelerated cost. In the process of setting up the business,.

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. In the process of setting up the business, karane has acquired various types of assets.

Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. To compute the maximum 2023 cost recovery for karane enterprises, including section 179 expense and bonus depreciation, we need to follow these.

Source: www.chegg.com

Source: www.chegg.com

Solved Karane Enterprises, a calendaryear manufacturer In the process of setting up the business, karane has acquired various types of assets. To calculate the depreciation expense for karane enterprises' assets acquired in 2022 and 2023, we need to use the modified accelerated cost.